Many Australians were surprised this week after opening their banking apps and seeing a Centrelink payment that was higher than usual. For some people, the increase was small and barely noticeable. For others, the extra money was significant enough to cause confusion and concern about whether an error had occurred. Centrelink has now confirmed that these higher payments are real and part of officially scheduled changes for 2026.

Why Centrelink Payments Have Increased

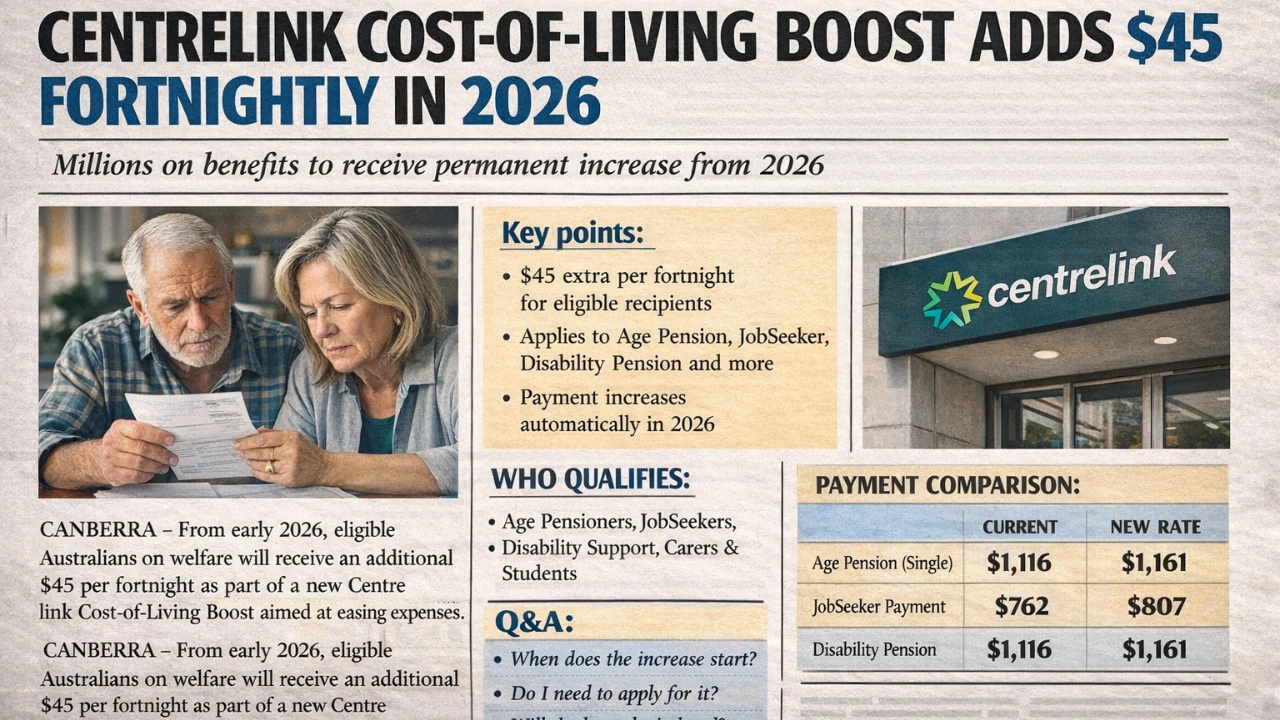

The higher payments are linked to routine adjustments made by the government to keep support payments in line with the cost of living and wage changes. These adjustments, known as indexation, are applied automatically. In addition to indexation, some payments have been reassessed and updated supplements have been included. As a result, millions of Australians are seeing changes in their deposits without needing to take any action.

Who Is Affected by the Changes

The increases apply to a wide range of Centrelink recipients, not just one group. Pensioners, JobSeeker recipients, carers, people with disabilities, parents receiving family payments, and others receiving allowances may all be affected. However, not everyone receives the same increase. The final amount depends on personal factors such as income, assets, supplements, and whether a backdated adjustment was included.

Why the Deposit Appeared Without Warning

Many people were confused because the first sign of the increase was the money appearing in their bank account. This happens because Centrelink payments are updated in the system before official notices are sent. In some cases, processing schedules also shift payment dates slightly. This can make it feel like the money arrived early or unexpectedly, even though it follows standard procedures.

Understanding Larger or Smaller Increases

Some recipients noticed a much larger deposit than usual. This can happen if backdated amounts were added to the regular payment. Others saw only a small increase or no noticeable change at all. Income levels, assets, and existing supplements can limit how much a payment increases. A higher deposit does not always mean a permanently higher ongoing rate.

What to Check If You Receive Centrelink

Most payment changes are correct, but mistakes can happen. If the amount looks unusually high or low, it is important to review your Centrelink online account. This will show updated rates and payment breakdowns. In some cases, payments can also go down if personal circumstances have changed or if updated information affects eligibility.

What to Expect Next in 2026

Further Centrelink adjustments are expected later in 2026 as additional indexation rounds are applied. These changes will also be automatic, and deposits may again appear before formal notifications. Staying aware of your account details helps avoid confusion.

Disclaimer

This article is for informational purposes only and does not provide legal, financial, or welfare advice. Centrelink payment amounts, eligibility rules, and timelines depend on individual circumstances and government policy. Readers should rely on official Centrelink or Services Australia sources for the most accurate and up-to-date information.